streamlining payment processes with eipp|Electronic Invoicing Presentment and Payment (EIPP) : Clark Start by organizing your customer data. Ensure you have up-to-date email addresses and preferred invoicing modes for all your customers. Import this data into your . Tingnan ang higit pa We have a range of support services available, from automated self-service channels, to direct contact with Evri customer service advisors. Starting a chat is the quickest way to get help. What you'll need to tell us Chat What's the chat service? Start a chat to get real-time information about your parcel, make immediate changes to your .

PH0 · electronic invoice presentment and payment solution

PH1 · Streamlining Deduction Management: How EIPP and Cash

PH2 · Electronic Invoicing Presentment and Payment (EIPP)

PH3 · Electronic Invoicing Presentment and Payment (EIPP)

PH4 · Electronic Invoice Presentment and Payments (EIPP): Achieving

PH5 · Electronic Invoice Presentment and Payments (EIPP): Achieving

PH6 · Electronic Invoice Presentment and Payment (EIPP):

PH7 · Electronic Invoice Presentment and Payment

PH8 · E

PH9 · An In

Villa Jalapa Private Resort, Rodriguez. 1,546 likes. Sitio Bangkal, Brgy. San isidro (Montalban) Rodriguez Rizal Private Pool

streamlining payment processes with eipp*******E-Invoicing and Payment Module (EIPP) Automatically generate invoices from completed sales orders, cutting down on manual data entry and the associated errors. Customizable invoice templates, a variety of payment options, and multi-channel delivery mean you can meet each customer’s . Tingnan ang higit paStart by outlining your goals, desired timeline, and key performance indicators for making the switch. Look for autonomous . Tingnan ang higit pa

Start by organizing your customer data. Ensure you have up-to-date email addresses and preferred invoicing modes for all your customers. Import this data into your . Tingnan ang higit pastreamlining payment processes with eippStart by organizing your customer data. Ensure you have up-to-date email addresses and preferred invoicing modes for all your customers. Import this data into your . Tingnan ang higit pa

Inform your customers about the upcoming change to electronic invoicing, emphasizing the advantages for them. Make customer support available for any pre- and . Tingnan ang higit paEquip your AR team with the skills they need to operate the new system. When evaluating software vendors, inquire about the training support they offer. Ensure that everyone . Tingnan ang higit pa

Agenda Payments: Today Electronic Invoicing. A brief history. What is EIPP? What does EIPP offer organizations? Who needs EIPP? What is the cost of paper? How might EIPP .

Streamlined payment processing as customers pay in a few clicks for faster remittance and simpler processing. Integration with ERP systems, accounting software and .Electronic Invoicing Presentment and Payment (EIPP)Enable faster payments with a secure, flexible digital self-service portal. Learn what an EIPP is and how this type of software can help you automate accounts receivable and . With EIPP, upfront deduction validations can be performed, allowing businesses to identify and resolve discrepancies before processing payments.

Electronic Invoice Presentment and Payment (EIPP) systems represent a transformative step in financial management, streamlining the invoicing process, . Fusion EIPP allows businesses to streamline their invoice processes and transactions through self-service portals and secure payment options. Automating the .

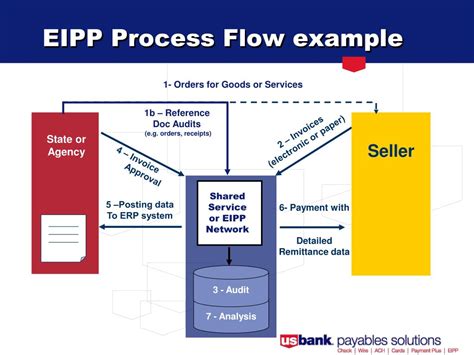

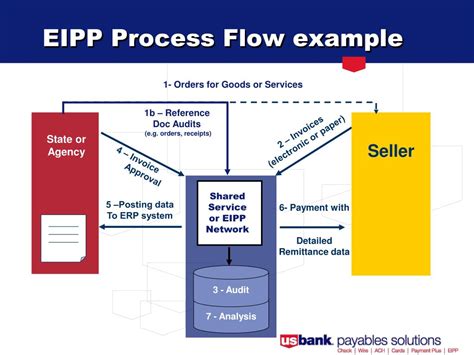

Identify which payment channel requires immediate attention for integration and whether it is transaction interchange optimization, PCI‐scope reduction or payment enablement. .EIPP is a business-to-business (B2B) solution where a Seller sends a digital invoice to its Buyers to expedite payment process. How It Works. Seller sends invoices to Buyers via .

EIPP Benefits • Eliminate no-value touch points in the invoice receipt process • Control over same day invoice receipt and faster processing (maximize touch-less processing and routing) • .

Introduction With the increasing digitalization of financial transactions, securing and optimizing transaction processes has become a necessity for every business. Recognizing the power and potential of innovative solutions like payment links in enhancing and streamlining the whole transaction process is crucial. In today’s fast-paced . A streamlined process often nudges you to embrace the digital realm. This wins you points with Mother Nature for reduced paper trails and paints your business green in more ways than one. Key steps to streamline payment processes. Navigating the vast ocean of payments can feel like being a sailor amidst a choppy, unpredictable, and . Automating payment processing tasks is an effective way to streamline the payment process. This includes automating tasks such as invoicing, payment reminders, and payment processing. By automating these tasks, businesses can reduce manual errors, improve efficiency, and save time and money.9 EIPP Benefits Eliminate no-value touch points in the invoice receipt process Control over same day invoice receipt and faster processing (maximize touch-less processing and routing) Eliminate/reduce exception handling with Pre-payment Audits Expand front-end discounts Faster payment processing best positioned for card product payment, .

Operational and security efficiency: Automating payment processes minimizes errors and frees your teams to focus on value-added tasks. Additionally, integrating robust security measures into payable processes helps protect sensitive information and build trust. Data-driven insights: Streamlined payment systems often .

While streamlining the payment process brings numerous benefits, it's essential to overcome the challenges that can arise during the implementation phase. Implementing a streamlined payment process is not without its hurdles. However, by addressing these challenges head-on, businesses can ensure a smooth transition and reap the rewards of .streamlining payment processes with eipp Electronic Invoicing Presentment and Payment (EIPP) 3. Data migration and system configuration. Cleanse and prepare data for migration, then configure systems to accommodate new payment processes and workflows. 4. Testing your payment hub. Thoroughly test your new payment system to ensure accuracy and identify any issues before going live. 5.

What is the $200 offer code for TwinSpires? For new customers, TwinSpires has a promotion where they can get an up to $200 sign-up bonus. The offer code can be applied in increments of $100 for every $400 wagered, therefore, to be eligible for the $200, you need to wager $800.

streamlining payment processes with eipp|Electronic Invoicing Presentment and Payment (EIPP)